Which of the Following Statements About Irr Is Not True

- The IRR is an expected rate of return. Which of the following statements is true.

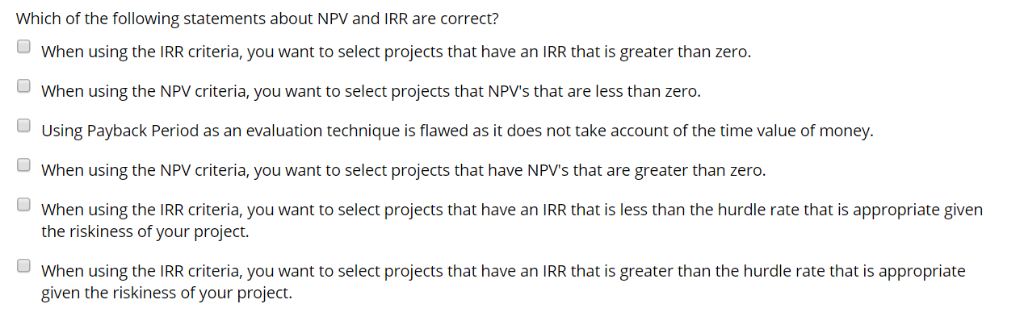

Solved Which Of The Following Statements About Npv And Irr Chegg Com

The act protects consumers from unfair.

. - The IRR is the discount rate that makes the NPV greater than zero. NPV assumes that cash flows are reinvested at the cost of capital of the firm. The IRR is the interest rate that sets the present value of a projects cash inflows equal to the present value of the projects cost.

B The IRR is a discounted cash flow method. A The IRR is the discount rate that makes the NPV greater than zero. D In case the capital.

If the nominal interest rate is 7. Unlike IRR NPV does not follow the value additivity principle b. C The IRR is an expected rate of return.

Average Rate of Return. All statements are true. -is true of fair use.

- None of these. Which of the following statements about IRR and NPV is incorrect. What is the approximate IRR of this project.

If a discount rate of 10 is used to calculate the NPV of the project which of the following statements is correct. Which of the following statements is true of fair use. Which one of the following statements about IRR is NOT true.

None of the above. If NPV is positive the IRR will be Positive. The IRR method can be used in place of the NPV method for all independent projects.

A The IRR is an expected rate of return. If a project has normal cash flows and its IRR exceeds its WACC then the projects NPV must be positive. Correct option is E The internal rate of return is the rate at which the net present value of a project is equal to zero.

For a project to be accepted IRR should be more than its cost of capital. D An inductor can conduct in a dc circuit but not a capacitor. If Project A has a higher IRR than Project B then Project A must also have a higher NPV.

The IRR is the. - The IRR is a discounted cash flow method. D A project could be rejected based on the IRR method while NPV method accepts it.

Which of the following statements about IRR is NOT true. IRR does not take into account the difference in the scale of investment alternatives. When undertaking one project prevents investing in another project and vice versa the projects have a positive payback.

In general you can reject the null hypothesis when x is very large. IRR assumes that funds generated from a project will be reinvested at an interest rate equal to the projects IRR. Among the conditions that may cause a project to have more than one IRR one might be the situation in which a negative cash flow or cost occurs at the end of the projects life in addition to the initial investment at time 0.

A A very simple circuit consists of a battery connected across a resistor. A segmented bar graph is useful in observing when two variables may be independent. First option is wrong because the IRR is not the NPV of an investment project.

If WACC is less than IRR of a strip mine project then the NPV of the project will always be greater than zero. Other things held constant an increase in the cost of capital will result in a decrease in a projects IRR. Solution for Which of the following statement is not true as part of building financial statement forecast model.

Detecting resistance is straightforward as long as organizations use impersonal media to communicate changes. For a chi-square test of independence the larger the x statistic the weaker the association between the two variables. C The IRR is a type of discounted cash flow method.

Which of the following statements is true. NPV and IRR yield the same ranking when evaluating projects. 1the voltage across each of the resistors is the same and is.

A project may have multiple IRRs when the sign of the cash flow changes more than once. Assume the cash flows arise at the end of each year. A The internal rate of return IRR is insensitive to the size of capital investments.

5 hours agoOriginal conversation. True False The graph contains a loop. Sign changes in the cash flow stream can generate more than one IRR.

Answer - K R. A main part of digital ethics focuses on. Issues with copyright violations.

IRR is easier to visualize and interpret than net present value NPV. If the cash flow stream has one or more cash outflows interspersed with cash inflows there can be multiple IRRs. If the cash flow stream has one or more cash outflows interspersed with cash inflows there can be multiple IRRs.

Which of the following statements concerning the NPV is not true. The IRR is the interest rate that sets the NPV equal to zero. Question 2 1 point Saved Which of the following statements about IRR Internal Rate of Return is NOT TRUE Assumes that any positive cash flow generated by the investment earn the IRR rate calculated for the given cash flows.

The IRR calculation implicitly assumes that cash flows are withdrawn from the business rather than being reinvested in the business. Answer - Internal Rate of Return. Which of the following statements is false.

Internal Rate of Return. Alternative Rate of Return. A main part of digital ethics focuses on.

Which one of the following statements about IRR is NOT true. B The IRR is the discount rate that makes the NPV greater than zero. C The profitability index PI is insensitive to the size of capital investments.

The internal rate of return is the rate at which the net present value of a project is equal to zero. The rate of discount at which NPV of a project becomes zero is also known as. 5 and the inflation rate is 4 then the real interest rate as per Fisher equation is 34.

If WACC is greater than the IRR of a project and the cash flows are conventional then the NPV of the project will always be less than zero. WACC adjusts for the tax deductibility of interest costs. Which of the following is not true regarding the IRR.

A conventional project has an initial cash outflow followed by one or more expected future cash. It is a metric that can be used to determine the relative profitability of investments based only on positive cash flows generated. For a project to be accepted IRR should be more than its cost of capital.

Both B and C above. D None of the above. B In case the capital investments are mutually exclusive and different in terms of sizethe internal rate of return IRR cannot be used as a decision criterion.

A mutually exclusive project can be chosen independently of other projects B. Rather IRR makes the NPV of an investment project equal to zero. IRR is the discount rate that makes the.

In general a very large x value matches with a very. Its an exception to copyright law.

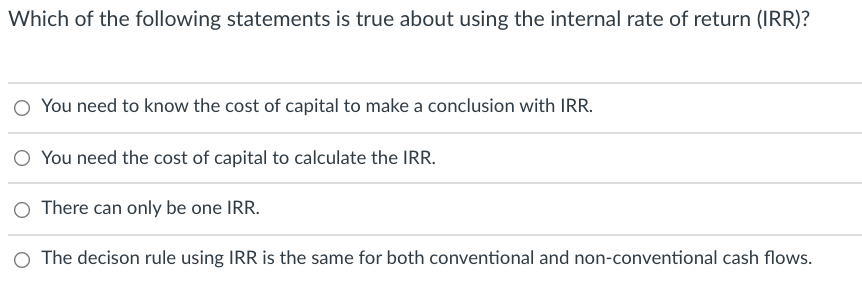

Solved Which Of The Following Statements Is True About Using Chegg Com

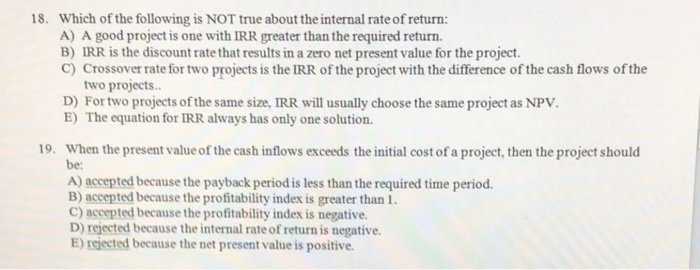

Solved 18 Which Of The Following Is Not True About The Chegg Com

What Is Irr Internal Rate Of Return Budgeting Process Budgeting Finance Saving

Quality Of Earnings Meaning Importance Formula And Report In 2022 Cash Flow Statement Financial Analysis Earnings

Comments

Post a Comment